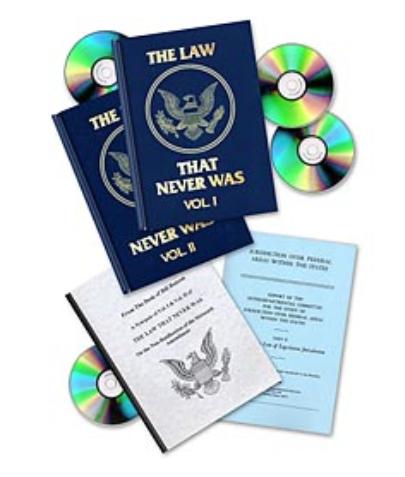

https://www.thelawthatneverwas.com/

The Premise

The federal government rests its authority to collect income tax on the 16th Amendment to the U.S. Constitution—the federal income tax amendment—which was allegedly ratified in 1913.

“The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

—The 16th Amendment to the Constitution of the United States of America

After an extensive year-long nationwide research project, William J. Benson discovered that the 16th Amendment was not ratified by the requisite three-fourths of the states and that nevertheless Secretary of State Philander Knox had fraudulently declared ratification.

It was a shocking revelation; it reached deep to the core of our American system of governance.

The Discovery

Article V of the U.S. Constitution defines the ratification process and requires three-fourths of the states to ratify any amendment proposed by Congress. There were fourty-eight states in the American Union in 1913, meaning that affirmative action of thirty-six was necessary for ratification. In February 1913, Secretary of State Philander Knox proclaimed that thirty-eight had ratified the Amendment.

In 1984 Bill Benson began a research project, never before performed, to investigate the process of ratification of the 16th Amendment. After traveling to the capitols of the New England states and reviewing the journals of the state legislative bodies, he saw that many states had not ratified. He continued his research at the National Archives in Washington, D.C.; it was here that Bill found his Golden Key.

This damning piece of evidence is a sixteen-page memorandum from the Solicitor of the Department of State, among whose duties is the provision of legal opinions for the Secretary of State. In this memorandum, the Solicitor lists the many errors he found in the ratification process.

These four states are among the thirty-eight from which Philander Knox claimed ratification:

- California: The legislature never recorded any vote on any proposal to adopt the amendment proposed by Congress.

- Kentucky: The Senate voted on the resolution, but rejected it by a vote of nine in favor and twenty-two opposed.

- Minnesota: The State sent nothing to the Secretary of State in Washington.

- Oklahoma: The Senate amended the language of the 16th Amendment to have a precisely opposite meaning.

Bill would like to thank all those who’ve contributed or shown support in the fight against fraudulent taxation. Click here to help.

When his project was finished at the end of 1984, Bill had visited the capitol of every state from 1913 and knew that not a single one had actually and legally ratified the proposal to amend the U.S. Constitution. Thirty-three states engaged in the unauthorized activity of altering the language of an amendment proposed by Congress, a power that the states do not possess.

Since thirty-six states were needed for ratification, the failure of thirteen to ratify was fatal to the Amendment. This occurs within the major (first three) defects tabulated in Defects in Ratification of the 16th Amendment. Even if we were to ignore defects of spelling, capitalization and punctuation, we would still have only two states which successfully ratified.

Important Headlines

READ ABOUT THE FRAUDULENT 17TH AMENDMENT AND THE RELATED DOCUMENTS’ DISAPPEARANCE FROM THE NATIONAL ARCHIVES

Devvy Kidd travels to Washington D.C. Click here.

SHERRY JACKSON CONVICTED—UNDER WHAT LAW?

Sherry Jackson convicted, click here for the full story.

CHECK OUT ALL THESE TAX CHEATS

Talk about tax cheats and tax protestors! Here they are—read and ask questions, write to these departments to find out why they believe they’re above the law. Click here for the list.

0 Comments