We Have All Been Trafficked Since Birth!

As a beneficiary (of the cestui que trust), you can receive the distributions and enforce trustee duty to the beneficiary. Hence, accept the “charge” and return to court for settlement OR accept it for value but DISSENT/refuse to accept trustee responsibility/liability and demand the trustee resolve the matter as required by being the SOLE party responsible for trust financial matters. The descriptions below may help you to clearly explain (rather than fight or argue with them) . Keeping calm, understanding this and explaining in a most professional but firm manner, is the best chance. If they deny this is a trust financial matter or trust relationship, then demand they produce the injured party under “Constitutional law”. Courts have 2 general jurisdictions, Contract disputes and torts. If no trust (contract), produce the injured party for the tort claim/liability.

Catch 22. In short, you accept “charge” and return to court for settlement or DISSENT as assumed trustee and return “Charge” to court to have other trustee(s) retain liability/responsibility for the “charge(s)”.

Either way, you are evidencing you are NOT liable. Trying the “PAY/DISCHARGE/OFFSET with these crazy bonds/bills of exchange/notes/etc, is a CLEAR VIOLATION of trust law as Beneficiaries DO NOT POSSESS AUTHORITY to Manage/direct or control assets/funds in trust. ONLY TRUSTEES can.

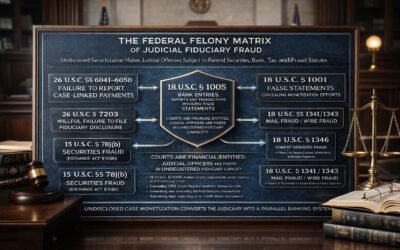

Trustees are legally responsible for managing trust assets in accordance with the trust document and applicable law. They owe fiduciary duties to beneficiaries, including the duty of loyalty (acting solely in beneficiaries’ interests), the duty of prudence (managing assets as a reasonably prudent person would), and the duty of impartiality (treating all beneficiaries fairly). Trustees must also avoid conflicts of interest, keep accurate records, provide regular accountings, and follow the trust’s terms precisely.

Grantors (also known as settlors or trustors) are the individuals who create the trust and transfer assets into it. They establish the trust’s purpose and terms but typically relinquish control over the assets once the trust is funded. In a revocable living trust, the grantor may also serve as trustee and beneficiary during their lifetime, but roles change upon incapacity or death.

Beneficiaries are the individuals or entities entitled to benefit from the trust. They have the right to receive distributions, access information about the trust, and enforce the trustee’s duties through court action if necessary. They are not personally liable for trust obligations but can recover mismanaged or improperly distributed assets.

Liabilities arise if a trustee breaches their fiduciary duties. Trustees are personally liable for losses caused by negligence, self-dealing, or failure to follow trust terms. However, they may protect themselves by obtaining fiduciary liability insurance or securing written consent from beneficiaries before taking risky actions. Courts can remove trustees, compel accounting’s, or order restitution for breaches.

Multiple trustees share joint responsibility, and under the Uniform Trust Code (UTC), co-trustees must act by majority decision, with dissenting trustees able to avoid liability if they document objections and prevent serious breaches. If a trustee resigns or dies, a successor trustee is appointed by the trust instrument or by court order.

“Accepted for Value” concept which does just that. “I accept this “charge” for “Value” and return it to the court for settlement”. This 1. Evidences the monetary “charge” made and that he accepts it as the beneficiary and returns it to the court (the trustee) for financial settlement. Brilliant BUT over the years, the courts just refused to honor it. My guess is that a “trustee” MUST voluntarily accept being the trustee.

So, KNOWING WHO is the current trustee is key to me as if you have CONCRETE PROOF of who the trustee is, you can accomplish this by declaring you are merely the beneficiary in the matter (NOT LIABLE) and evidence and claim the trustee’s role and responsibility for all financial matters of the trust THEY ARE RESPONSIBLE FOR and you “DENY VOLUNTARY ACCEPTANCE” of becoming a co-trustee for responsibility for the “Trust charges” before the court.

Now for my comment re the Trustor/Settlor/Grantor. Notice above for the Grantors: Not only are they the “Creators” of the trust, they funded the trust AND APPOINTED THE TRUSTEE(s) to manage trust assets AND Grantors “establish the trust’s purpose and terms” of the trust, meaning, the Trustor/Settlor/Grantor controls the trustees actions, via “agency/fiduciary duty to Grantor to complete the wishes of the Grantor AND the beneficiary (also you) placing property in Trustee possession. Note also, the trust itself WAS SET UP (unknowingly and non consensual as it was) by the Trustor/Settlor/Grantor as well as the TERMS AND PURPOSE of the trust (INCLUDING THE ASSETS HELD THEREIN). To me, the Trustor holds power over all trustees because NOTHING EXISTS without the Trustor/Settlor/Grantor’s knowledge and consent to even create a trust, let alone place liability/responsibility of trust financial responsibilities.

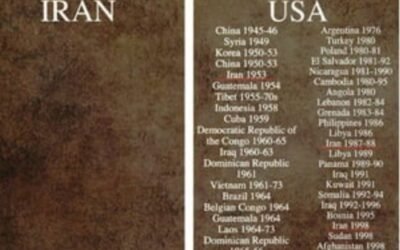

If a “Trustee” creates/sets up a trust using Grantor assets WITHOUT GRANTOR KNOWLEDGE AND CONSENT, this is a CLEAR SHAM TRUST entitling all assets held in trust be returned to the Grantor for Sham Trust damages as a result. Now, to set them all up for this “How do you plead? Your honor, because this is a civil matter, it MUST BE EITHER a Contract dispute or tort and because there is no “injured party is present”, I can only conclude that this matter is contractual and I must be the Trustor/Settlor/Grantor of an unknown trust relationship, as evidenced by the commercial nature and financial bond in this matter, and as such I hereby declare a sham trust was set up, by the trustee(s), without my knowledge or consent, to obtain “legal ownership” over my estate assets” for personal self enrichment by the trustee(s) which I never even knew I appointed as my trustees over a trust relationship, using my assets as the corpus, equating to a sham trust. As a result, I, as the unwitting and original trustor/Settlor/Grantor in error & hereby invoke Constructive trust to dissolve this sham trust and demand all assets held in trust be returned to me immediately as a result of the damages to me cause by the alleged trustees in creating this sham trust for their own personal financial gain and control over my assets held in trust, again, without my knowledge or consent.

For best results, ask the judge a few questions 1st.

Is this civil matter a contract dispute or tort?

Does this civil matter involve any type of trust relationship, rather express or implied, revocable or irrevocable or resulting or Constructive in nature?

Does the bond in this matter serve as evidence of a financial (asset based) contractual relationship between the parties or this court?

If they answer, you can then proceed with either the beneficiary Accepted for Value above or the Trustor dissolution of trust theory.

0 Comments