GRACE COMMISSION REPORT

I realize some of you may be thinking “What will support the services offered by the government of none of us pay federal income tax?” Well, below is a report requested by President Ronald Reagan to see just where the Federal Dollar goes.

The Grace Commission confirms the allegation that th income tax revenues go 100% to pay the interest on the national debt. January 12, 1984

Something to Ponder

C.R.S. Report Congress 92-303A (1992) by John R. Lackey, Legislative attorney with the library of Congress: “When a court refers to an income tax as being in the nature of an excise, it is merely stating that the tax is not on the property itself, but rather it is a fee for the privilege of receiving gain from the property. The tax is based upon the amount of the gain, not the value of the property.”

Coppage v. Kansas 236 U.S. 1 (1915): “Included in the right of personal liberty and the right of private property- partaking of the nature of each- is the right to make contracts for the acquisition of property. Chief among such contracts is that of personal employment, by which labor and other services are exchanged for money or other forms of property.”

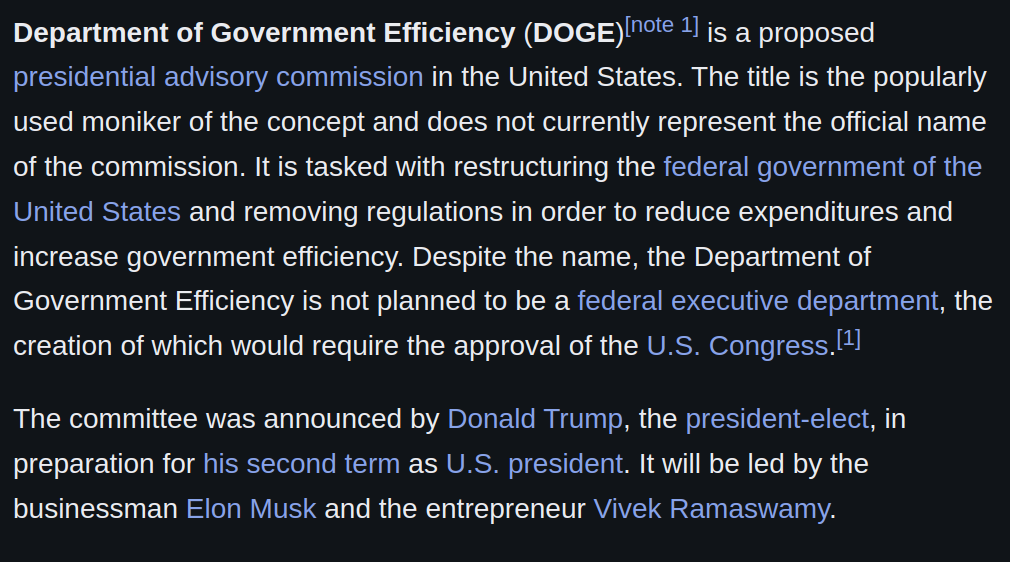

The Private Sector Survey on Cost Control (PSSCC), commonly referred to as the Grace Commission, was an investigation requested by United States President Ronald Reagan, authorized in Executive Order 12369 on June 30, 1982. In doing so President Reagan used the now famous phrase, “Drain the swamp”.[1] The survey’s focus was on eliminating waste and inefficiency in the United States federal government. Businessman J. Peter Grace chaired the commission.[2] Reagan asked the members of that commission to “Be bold. We want your team to work like tireless bloodhounds. Don’t leave any stone unturned in your search to root out inefficiency.”[3]

GRACE COMMISSION REPORT

Grace Commission 2.0 @elonmusk @VivekGRamaswamy @realDonaldTrump @TulsiGabbard @TuckerCarlson

If government services are not, and obviously never have been, from income taxes, what purpose does the income tax really serve? They could just print more money right?.

Page 4 of… pic.twitter.com/wnTVP0ZzRm— Paradigm Shift P. C. (@7_paradigm) December 21, 2024

This is a heat map showing countries with the lowest tax rates.

Do you have a strategy to implement when it’s time to take profits, are you setup.

Get ready for the bullrun of your life. Don’t f*ck this up. pic.twitter.com/YlI6edQupE— Mr. Man (@MrManXRP) September 27, 2024

0 Comments