THE EPSTEIN SECURITIZATION MACHINE

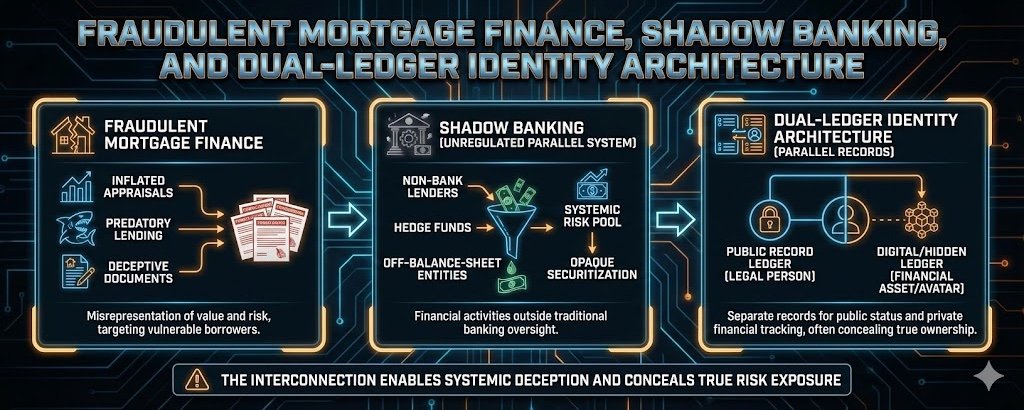

A Definitive Case Study in Fraudulent Mortgage Finance, Shadow Banking, and Dual-Ledger Identity Architecture

Abstract

Jeffrey Epstein’s investment activity in mortgage-backed securities (MBS) is more than an obscure detail of his financial history; it is a rare, transparent demonstration of how modern securitization, offshore corporate structuring, and the global rehypothecation system actually operate behind the façade of regulated finance. Epstein’s internal records, paired with analyst memoranda from J.P. Morgan and Deutsche Bank, reveal a system built not on lawful conveyance, trust principles, or sound underwriting, but on hypothecation, synthetic credit creation, and institutionalized fraud.

This article analyzes Epstein’s mortgage-securities portfolio as a live case study in the deeper mechanics of the shadow financial system, an architecture sustained by the separation of the living individual from the legal fictions that hold assets, absorb liabilities, and circulate as commercial vessels in global markets. Epstein’s operation, when examined through a lawful, jurisdiction-based lens, exposes the internal contradictions and systemic fraud at the core of contemporary mortgage finance.

I. SYSTEM BUILT ON DUAL LEDGERS

One of the most revealing aspects of the Epstein financial records is the dramatic gap between his personal disclosuresand the assets controlled through his corporations.

In official paperwork, Epstein’s personal profile listed:

-

Annual income: less than $50,000

-

Net worth: less than $50,000

-

Liquid net worth: less than $50,000

Yet his controlled entities, including Southern Trust Company, Financial Trust Company, and Financial Informatics, held hundreds of millions of dollars in assets.

This duality is not accidental; it reflects a pervasive feature of the modern financial system: the split identity between the living man and the legal persona (ens legis). Corporations, like the ALL CAPS PERSONA used by governments, serve as artificial vessels engineered for:

-

asset accumulation

-

liability insulation

-

jurisdictional arbitrage

-

tax avoidance

-

securitization and hypothecation

Epstein mastered this structure. Banks recognized and enabled it.

The living man disappeared; only the entities mattered.

This dual-ledger architecture is the cornerstone of how modern finance abstracts real human beings into monetizable legal fictions.

II. Entering the Machine: Epstein’s Exposure to the Mortgage Securitization Pipeline

Epstein did not merely dabble in retail investments; he positioned himself directly inside the flawed, fraud-laden midsection of the mortgage securitization chain, the precise stage where the industry’s structural defects become most apparent.

His entities acquired significant positions in subordinated mortgage-backed securities (MBS) tranches:

-

Countrywide Home Loans 03-1 (B1)

-

Global MTG Securitization Ltd (B2)

-

Impac CMB Trust 2005-2 (1M2)

-

Washington Mutual Mortgage Securities (CB2)

-

Goldman Sachs Mortgage Securities (B1)

These were not senior AAA instruments; they were first-loss tranches, high-yield securities engineered to absorb defaults before any senior bonds experienced impairment.

In other words, Epstein was buying the toxic waste.

Why does this matter?

Subordinated bonds reveal the true condition of the underlying loans first. They expose:

-

inflated appraisals

-

fraudulent underwriting

-

fabricated borrower income

-

non-existent documentation

-

REMIC trusts that never received the notes

-

decaying collateral quality

-

internal insolvency masked by credit enhancements

Epstein’s portfolio placed him at the very point at which securitization fraud becomes undeniable.

III. What the Banks Saw: Internal Memos Proving Knowledge of Fraud

Deutsche Bank’s internal communications, produced during regulatory investigations, show unequivocally that analysts and trading desks understood the securities they were selling to Epstein were collapsing.

Key observations included:

-

“Monthly principal payments dropped 85%.”

-

“Delinquency on the pool is 9%.”

-

“Credit enhancement has fallen to 5%.”

-

“B3 subordinate tranche has stopped paying altogether.”

-

“Most of the tranches you own will experience losses.”

These disclosures establish that the banks knew the securities were failing, yet trading continued.

Derivatives were written. Collateral was pledged. Leverage was extended.

This was not negligence or oversight; it was a calculated strategy embedded within the shadow banking system.

IV. The Shadow Banking Interface: How Epstein Accessed the Private System

What distinguished Epstein from ordinary investors was not the type of assets he held but the tier of the system within which he was allowed to operate.

J.P. Morgan and Deutsche Bank granted him:

-

direct access to structured product trading desks

-

bespoke derivative structuring

-

$71 million in complex derivative exposure

-

multiple offshore entity accounts

-

priority execution on MBS trades

-

integration into global collateral networks

This level of access is normally restricted to:

-

hedge funds

-

sovereign wealth funds

-

global family offices

-

institutional proprietary trading groups

Epstein’s corporate entities functioned as private ens legis constructs, permitting him to navigate the same offshore, opaque liquidity channels used by multinational banks and ultra-high-net-worth clients.

This is the real financial system, one unavailable to the public and unrecognizable to most regulators.

V. The Legal Illusion of the Trust: Why Securitization Was Void at Its Foundation

The mortgage loans backing Epstein’s securities were originated by lenders such as Countrywide and Washington Mutual, institutions later exposed for rampant fraud, predatory practices, and the fabrication of borrower data.

Under trust law, a REMIC Trust can only issue securities if:

-

The trust receives the mortgage notes.

-

Transfers occur before the trust’s closing date.

-

The depositor possesses the right to convey.

-

The chain of title is complete and lawful.

But, the overwhelming evidence across thousands of securitization cases shows:

-

notes were never conveyed

-

endorsements were fabricated years later

-

custodians held only scans, not originals

-

REMIC tax rules were violated

-

trusts received non-performing assets

-

nearly all assignments were void

Thus, as a matter of lawful trust doctrine, the REMIC trusts backing Epstein’s securities were never valid trusts at all.

They were legal fictions used as packaging mechanisms for financial engineering.

Epstein bought instruments backed by NOTHING, and so did millions of pension funds, municipalities, and investors worldwide.

VI. The Final Layer: Global Rehypothecation and Infinite Leverage

Once Epstein’s entities acquired these bonds, they did not simply sit idle.

They became:

-

repo collateral

-

building blocks for derivative contracts

-

inputs for total-return swaps

-

components of structured notes

-

instruments pledged in multiple jurisdictions

-

assets rehypothecated across European collateral networks

Under UK and offshore collateral rules, a single MBS tranche may be repledged without limit, creating multiple synthetic claims to the same underlying asset.

The result?

-

exponential leverage

-

phantom balance-sheet strength

-

interbank liquidity fueled by non-existent collateral

-

systemic risk disguised as innovation

Epstein was integrated into this machinery. His securities, though failing, were treated as collateralizable assets within a global liquidity loop.

This is the same mechanism by which governments generate synthetic value from a birth-registered legal person, an ens legis structure that is repeatedly monetized without the knowledge or consent of the living individual.

VII. What the Epstein Case Reveals About the Financial System as a Whole

Epstein’s mortgage-trading portfolio is not a footnote; it is an X-ray.

It reveals:

-

A Dual-Ledger Identity Architecture – Living individuals appear asset-poor while artificial entities accumulate wealth.

-

A Mortgage System Built on Structural Fraud – From origination to trust conveyance, nothing occurs as legally required.

-

Institutional Complicity – Banks knowingly facilitated trading in securities they admitted were failing.

-

Synthetic Finance Replacing Real Assets – The system depends on derivatives, credit enhancements, and rehypothecation—not lawful title or performing loans.

-

A Private Financial System Operating Above the Public One – Epstein’s access to structured desks, derivative layers, and offshore accounts demonstrates the existence of a parallel financial universe.

-

Proof of the Broader Jurisdictional Model – The same structural principles that govern mortgage securitization, inversion, hypothecation, and legal-fiction separation also govern the broader relationship between the State and the individual.

VIII. Epstein as a Microcosm of a Global System of Fraud

Jeffrey Epstein’s MBS activities offer direct evidence of a hidden truth that financial institutions rarely acknowledge:

The modern securitization system is not a lawful trust-based framework; it is a synthetic credit engine built on the monetization of legal fictions, fraudulent documentation, and global rehypothecation.

Epstein did not design this system; he merely operated within it at a privileged level, using corporate entities as private vessels for risk, leverage, and asset control.

For the public, participation in this system is involuntary, imposed by the creation of the legal persona at birth and maintained through statutory presumption.

For Epstein, it was voluntary, deliberate, and richly rewarded.

This case study confirms what many have long suspected, but few could prove:

The financial system does not fail because of fraud; fraud is its operating model.

0 Comments