Monday Afternoon

Sunday Night Asian Open

By Benjamin Picton, Senior Macro Strategist at Rabobank

Source: https://www.zerohedge.com/markets/why-would-markets-believe-any-central-bank-assurances-ever-again

The Boy Who Cried Wolf

Jerome Powell set off another sharp fall in US bond yields on Friday by suggesting that “it would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance”. Huh? Obviously he intended this to be a hawkish statement, but the market laughed it off and duly bought bonds anyway. Clearly, traders don’t trust the Fed Chair to deliver on any further monetary tightening as there is virtually zero probability of further rate hikes priced into Fed Funds futures, and 5 cuts priced in by the end of 2024.

Indeed, speculation that the hiking cycle has already concluded gained momentum after Powell said that monetary policy is “well into restrictive territory”. This helped the 2-year yield closed up by 14bps, the 10-year up by 13bps and the S&P500 up by 0.59%.

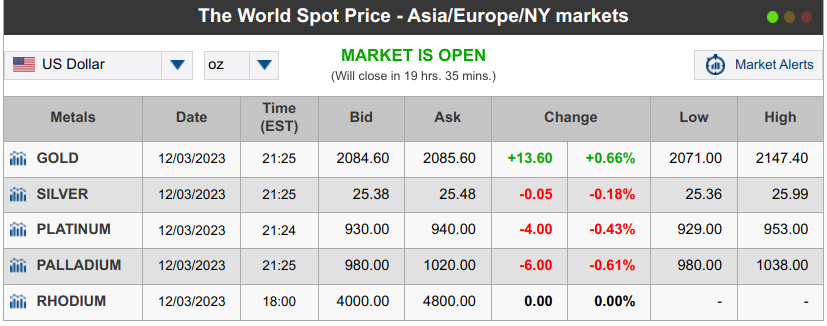

The price action became even more interesting on the Asian open today. Gold prices hit a new all-time-high of $2,135/ounce and Bitcoin busted through the $40,000 level. What does this tell us? If asset classes variously disparaged as an “pet rock” and “digital magic beans” are surging, are we heading back to the ‘good times’ of the Covid bubble economy? Or are higher prices for zero-yield monetary alternatives a signifier of the market’s (lack of) confidence in the US Dollar?

There is some argument for the latter. The DXY index has been under substantial pressure as rate cuts get pulled forward along the yield curve and signs of deflation emerge in major economies. The WSJ today reports on the deflationary trend, and points out that it provides a tailwind for central banks in their crusade to achieve their price stability targets, even as services price inflation remains stubbornly high.

No doubt that’s true, but how do you make sure you have just the right amount of deflation in just the right places? Last week’s announcement of “voluntary” OPEC+ production cuts of a further 1 million barrels per day have done nothing to staunch the weakness in crude oil prices, even as the unit of account that crude is denominated in (the USD) is falling fast. What does that tell us about the state of economic activity? Maybe the deflation is further along than popularly acknowledged.

If the WSJ judges a little bit of goods deflation to be no bad thing, they’re in good company. In 1888 the celebrated Cambridge economist Alfred Marshall (he of the Marshallian Demand) told a Royal Commission that “the evils resulting from a fall in prices are commonly overrated. I think that it is not clearly established that a rise in prices is to be preferred to a fall.”

Obviously, the modern view is that a rise in prices IS to be preferred to a fall. This is the orthodoxy among central bankers, who have long seen lower consumer prices as an existential threat to the economy. This thinking has become so ingrained since the adoption of inflation targeting in the early 1990s that the “rate cuts soon” meme that we sometimes poke fun at is really just a reflection of the mathy reaction function of your garden variety inflation-targeting central bank. This is the reason why bets on rate cuts are being brought forward, even as central bankers protest their seriousness on “higher for longer”.

There is an element of ‘The Boy Who Cried Wolf’ here. Why would markets believe central bank assurances of hawkish intentions when they have never delivered hawkish rates policy at any point since Long Term Capital Management blew up in the late 1990s? Have they updated their models, or revised their view of how the economy works?

Of course, the answer is no. After the three years we’ve just had (and the 12 years that preceded it) it might make sense to ask the question whether price stability mandates have been a good thing. In fact, the recent review of the Reserve Bank of Australia did ask this question, and concluded perfunctorily with a “yes, they have”. So, why did we have the review again?

In reality, few mainstream economists seriously question the usefulness of inflation targeting regimes. Despite suggestions that financial crises becoming more frequent, inflation targeting is treated as infallible, and widely accepted as best practice the world over. This was not always the case. The Fed itself did not have a formal inflation target until Ben Bernanke introduced one 2012, and in 1937 the Australian Monetary and Banking Commission had this to say on the matter:

“Price fluctuations are little more than symptoms, and the monetary authorities should not seek to regulate credit with regard to a price index.”

The implication here is that ‘price stability’ mandates are not some modern intellectual breakthrough cooked up in New Zealand in the 1990s, but an old idea that was repeatedly rejected in the past. Why was it rejected? Because, to paraphrase Mervyn King, it can result in measuring things that are not important and failing to measure the things that are important.

There is an argument to be made that capitalism breeds productive efficiency, which lowers unit costs over time. This implies a natural deflationary bias. If you set policy so that prices will grow at 2% p.a. in the face of this, it could be argued that policy rates will always be (structurally) too low, and therefore encourage speculation and the formation of credit bubbles. (Bitcoin is at $40,700 now!)

So, is it a coincidence that inflation targeting was adopted in the 1990s, asset price bubbles began in the 1990s, and policy rates have been marching lower ever since the 1990s? Rate cuts soon!

0 Comments