Everyone should have an MEV bot that generates $30,000 a month!

Anyway, many believe it requires years to create one.

I spent just 6 weeks developing a bot that earns around $900 daily…

Here’s how to set it up in just 10 minutes and start profiting today! ?

➥A well-optimized MEV bot on Solana can result in remarkable success during this market cycle.

➥Achieving millions in monthly earnings is attainable for MEV bots fueled by #ChatGPT.

➥Act swiftly to develop your own AI MEV bot before market conditions change!

• Arbitrage opportunities;

• Significant trades that influence prices;

• Lack of liquidity, and much more.

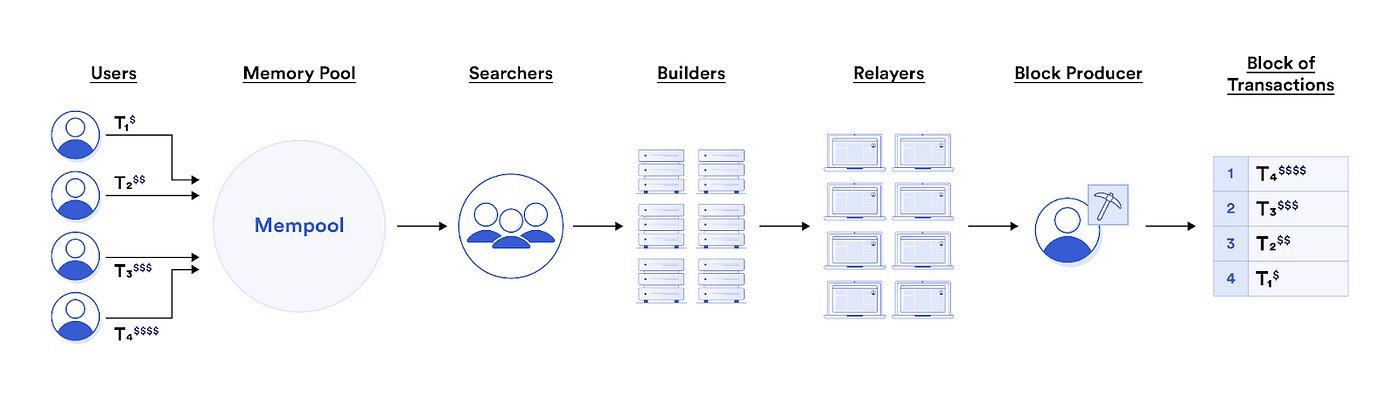

➥The bot scrutinizes the mempool to spot profit opportunities by front-running other transactions.

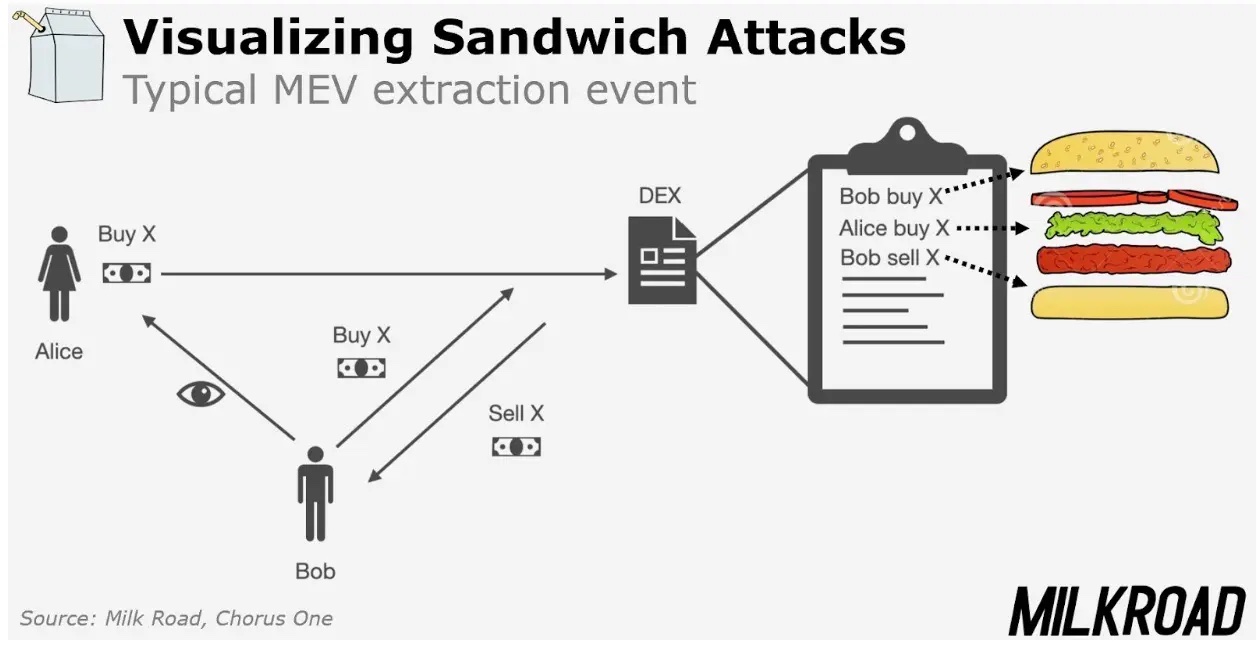

➥The main types of MEV strategies are Arbitrage and Sandwich.

➥Their objective is to identify transactions that generate price discrepancies between two exchanges.

➥The token is purchased at a lower price on one platform and sold at a higher price on another.

➥For instance, a $1M transaction to buy a low-cap meme coin shows up in the mempool.

➥A Sandwich MEV bot detects the transaction, buys the token, and sells it after the whale’s $1M purchase.

➥Earnings usually hinge on market activity, volatility, and the bot’s configuration.

➥Secure a fully passive income before these bots become widely available!

➥First, ask #ChatGPT to generate a script that examines the blockchain’s mempool.

➥This is the cornerstone of your MEV bot, so take your time to perfect it!

Please write a script in rust for the solana mempool which will find all possible transactions.

ChatGPT said:

➥Go to @ChatGPTapp

and ask for a script to examine this mempool.

➥This section is essential for spotting early-stage tokens.

Please write a script in rust for the solana mempool with all possible transactions which execute a detailed analysis

➥Its key function is to track token prices across various DEX/CEX platforms.

➥Be sure to add a script that evaluates token liquidity and trading volumes!

make a script for an arbitrage bot which will analyse the prices of sol memcoins and show prices.

➥The bot should initiate a transaction ahead of time after assessing the whale’s purchase.

#ChatGPT can handle this task efficiently.

make a script for the solana blockchain which will send transactions for huge buyers based on transactions of the solana ChatGPT said: ChatGPT

➥Compile all sections of the code into one request and ask to merge them into a working script.

➥Ultimately, you’ll have a fully functional MEV bot!

Find Arbitrage Opportunities

Qurey:

//find arbitrage opportunities

let opportunities = find_arbitrage_opportunities(price);

//Print Results

for opportunities in opportunities {

printint{

“Arbitrage Opportunity: Token{}, Buy Price{}, Sell Price{}, Profit Margin: {“:2}%”,

opportunity token, opportunity buy_price.

opportunity sell.price, opportunity profit margin

}:

}

OK({})

}

// Fetch price from DEX 1 (Raydium or Orca)

async fn fetch price

➥This will allow you to identify any potential code errors early on.

➥If an issue arises during testing, @ChatGPTapp can swiftly fix it!

Be sure to check out these individuals who frequently share exciting projects:

@0xJok9r

@belizardd

@wist_defi

@0xAndrewMoh

@CryptoShiro_

@DeRonin_

@CryptoGideon_

@kem1ks

@AlphaFrog13

@arndxt_xo

@0xSpartacus__

@KingWilliamDefi

@dealerdefi

@cryppinfluence

@KashKysh

@0x99Gohan

@CryptoStreamHub

@the_smart_ape

@lenioneall

0 Comments